Sell in May and go away? or Hedge a quarter and sleep better?

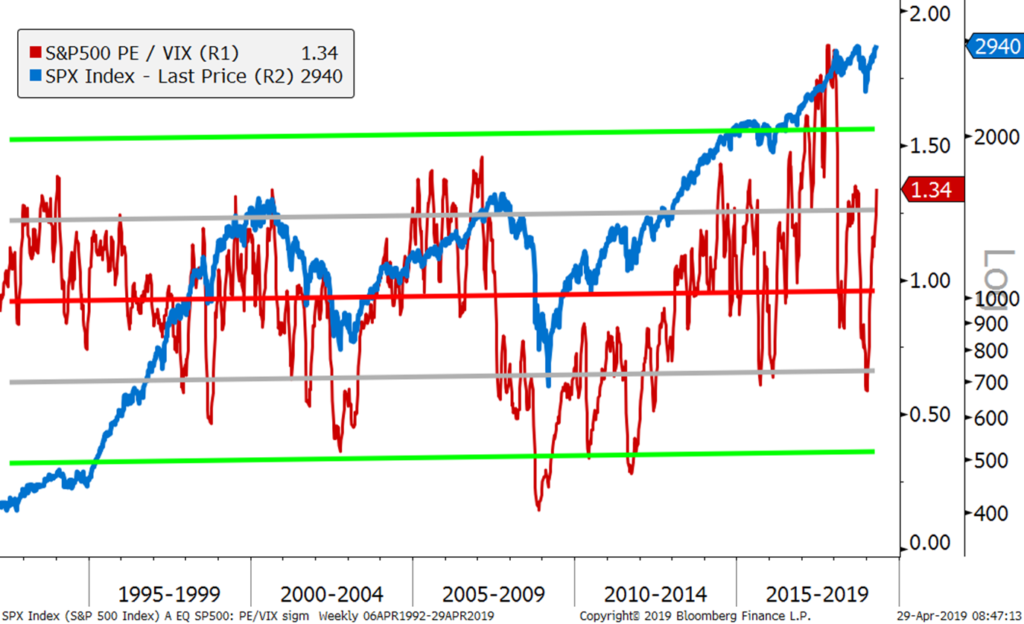

It was an extraordinary time to hedge a portfolio (or take profit) in November 2017 when the ratio S&P 500 PE/VIX reached 1.80 and was close to 3 standard deviation away from its mean (refer to our November 2017 Chart of the Month).

It was a great time to hedge a portfolio in September 2018 when this ratio reached 1.35 and was trading more than 1 standard deviation away from its mean.

After the very strong equity markets recovery this year, is it now also a good time to hedge a portfolio now that this ratio is back to 1.34 level?

Buying a put is always “too” expensive, unless your get the timing right with short maturities. It is all about finding the right balance between the underling, the maturity, the strike price and the volatility.

Whilst there are good reasons to continue to be bullish in the near term (central banks have changed policies to be more accommodative, earnings growth remain solid, global inflation is contained, trade negotiations are progressing…), we think now is a reasonable time to hedge a portfolio.

As an example: a 2% out-the-Money PUT on the S&P 500 Index with a December 20, 2019 maturity costs today about 3.3%. Therefore you can reduce your portfolio risk by 25% (or a Quarter) at a cost of 0.83%. In addition, to reduce the risk of timing, you could scale in over the next few weeks.

As the old adage says “Sell in May and Go Away”, we think it makes more sense to hedge a quarter and sleep better with an end-2019 horizon. It is a good way to remain invested with an insurance which cost is only the performance of the last 2 or 3 weeks.