“Who you trying to get crazy with this thing? Don’t you know I’m loco?”(*)

Hip-hop does not have a lot in common with financial markets and this 1993 song from Cypress Hill was obviously not aimed at giving any reference to any asset class whatsoever.

But when looking at the overall bond market today, “insane” is clearly the first word that comes to mind. To put it bluntly, how can so many investors accept to pay for holding debt securities? And why do so many market observers try to find far-fetched reasons to justify this present insane situation?

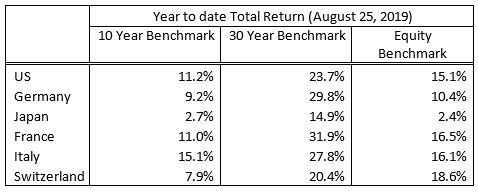

With some hindsight, it is difficult not to feel some reminiscences of the 1999 tech bubble: crazy valuations, spikes in prices, incoherent reasoning, abruptly all good reasons to buy because “things are different this time”, and in many cases the quasi-certitude to lose money over the long term. In fact, those buying German, French, Japanese or Swiss Government bonds today are sure to lose money if they hold it to maturity, whereas in 1999 at least those buying stupidly valued Internet companies could eventually have hoped to see them acquired at an even more stupid price.

In such a situation, it is unfortunately impossible to time the end of the madness, therefore extremely perilous to go short the assets that, in a logical world, should be shorted. A dear price had been paid by many brilliant investors in 1999 for having gone short the Nasdaq too early; the same applies this year with shorts on extended duration fixed income assets. But, remember how rewarding it was in 2000 to be short the Nasdaq, or at least to be away from it; it is a lesson that must be remembered.

The market will, from time to time, test convictions and drive prices far too high or far too low, much farther than most participants can cope with, which explains why there are buyers at tops and sellers at bottoms when common sense would recommend doing the opposite. Driving investors crazy and pushing them to make insane decisions is not an unusual behavior from Mr Market: “Who you trying to get crazy with this thing? Don’t you know I’m loco?”.

Coming back to today’s situation, how to deal with these negative yielding assets? For those who were brave and smart enough to hold them until now, we would advise to drastically reduce the exposure; and for the others to shy away, and concentrate on real businesses which generate cash-flow, increase earnings, invest, and are reasonably valued. Because this is the other insane consequence of abnormally low yields: how to discount future flows with incoherent factors? In theory a good company with low debt, good cash flow and an attractive dividend could be valued at insane multiples as well…

This comforts us with our positive stance towards equities, well balanced across sectors.

(*)“Insane in the brain”, Cypress Hill (https://www.youtube.com/watch?v=RijB8wnJCN0 )