In Re-Search of Alpha

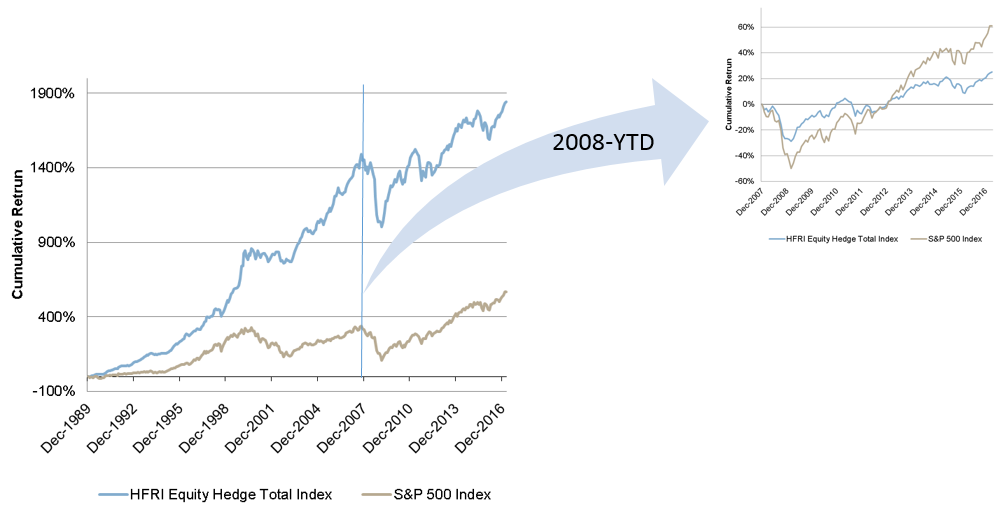

Alexander Ineichen of UBS Warburg was well known in the hedge fund world for his first publication in 2000 of a series of four to follow titled “In Search of Alpha – Investing in Hedge Funds”. This was a guide written to de-mystify hedge fund investing following the hedge fund industry’s two decades (the 1980s and 90s) of spectacular returns. Coincidentally, this publication was released just after Reg FD (Regulation Fair Disclosure) was introduced in August 2000 putting an end to inside information. At the time hedge fund assets totaled $491 bn. (having increased more than twelvefold from a decade earlier). Although hedge funds survived the dot-com bubble bust in 2002, hedge fund returns overall became more muted before collapsing in 2008 due to the global financial crisis (GFC) and marking the beginning of what may be considered the “lost decade” for hedge fund investing with sub-par returns. With total hedge fund industry assets totaling more than $3 tn. Today (despite over 8,000 funds having shut down since the GFC), generating Alpha has become very challenging in an environment of zero/negative interest rate policies across the globe that has followed various quantitative easing initiatives in China, the US, Japan and Europe. Chasing market Beta has been the layup trade of the decade and unfortunately many hedge fund managers (both in the Equity Long Short and Discretionary Macro space) have missed out on or been penalized by their short exposure. Any announcement of quantitative easing has turned out to be a catalyst for a significant market rally (in China, the US, Japan and Europe) and one would have been better off being leveraged long chasing market Beta to generate outstanding returns. Another set of successful layup trades would have been to be long the local equity market following the destitution/election of a new president/prime minister. This was the case in Japan, Brazil, Argentina, India and more recently in the US sparking double to triple digit market rallies (in percentage terms).

Hope can go a long way in sustaining equity markets (despite mediocre fundamentals) making it very difficult for hedge funds to generate alpha. So no wonder low cost ETFs (index tracking funds) have been attracting $131 bn. just in the first two months of the year taking total assets in this space to over $3.6 tn. There is not a week that goes by without the press criticizing the underperforming active management industry that charges high fees versus low cost ETFs. Yet there is a breed within the hedge fund industry that has been generating impressive returns on a consistent basis. Call them computer nerds for lack of a better definition, quant high-frequency trading funds essentially based on short term stock price moves (as opposed to changes in underlying fundamentals of a company) have been slowly chipping away at generating Alpha and amassing the most significant amount of hedge fund assets in recent years. Perhaps the proliferation of ETFs has worked in their favor but one thing is certain, market moves have increasingly become shorter term in nature. With high frequency trading accounting for up to 50% or more of trading volumes in the US and possibly in Europe, generating alpha has become ever more challenging. At some point markets will no longer continue to trade on hope alone and the third greatest US bull market in modern history will come to an abrupt end. There are still a number of hedge funds that are well worth investing in despite the criticism by the press so would you rather not be hedged in equities when the tide turns? With ETFs and risk-parity products having amassed billions of dollars chasing performance, a rapid reversal in markets could snowball into massive selling within a short space of time and could prove to be not as liquid as intended (on August 24th, 2015 more than 1/5th of US-listed ETFs were forced to stop trading as the Dow lost 1,000 points in early trading). Buyer beware!