European Financials: banking on the right stuff

The whole financial sector in Europe has quite often been qualified as a disaster for equity investors since the GFC. It’s been now almost 10 years since the market bottomed in 2009, and an investor in European financial stocks during these 10 years has had to cope with strong headwinds and a high level of stress; remember before 2008 how fast the sector, and especially banks, rose. From the end of 2002 until the end of 2006, the European banking sector has compounded at a whopping 20.5% dividends included….

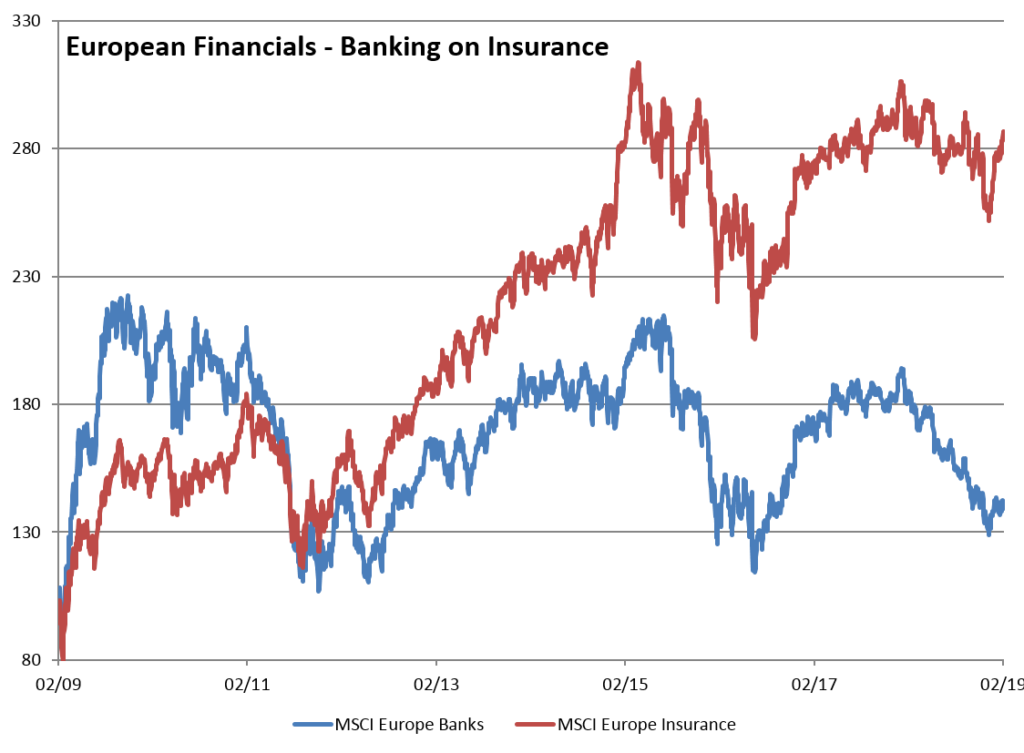

If we now turn to the last 10 years, the numbers have changed dramatically: from February 2009 until today, the sector has returned 7.5% annually with dividends (3.4% without dividends), but as can be seen on the chart of the month, timing was critical. An investor having bought the European banks index in November 2009 will have lost 1.1% annualized with dividends as of today (-4.6% without dividends), which explains the disdain expressed by many portfolio managers vis-à-vis the sector.

But financials are not made of banks only; by contrast, the Insurance sector has been on fire for the last 10 years, and even if it has been volatile, timing was far less decisive: since February 2009 the Insurance sector has returned 15.7% annually with dividends (7.6% without), and from November 2009 until today the numbers are still appealing: +11% annualized total return (+6.2% without dividends).

How has such a discrepancy been possible? Regulation, a heavy burden for the financial sector, has been much more damageable to banks as it has forced them to increase capital on a permanent basis, hampering shareholders’ returns. Another factor has obviously been the huge fines banks had to pay to US and European authorities, a casualty that has been avoided by insurers. The aftermaths of the GFC have also been more painful for banks than for insurance companies, who did not have to cope with rising non-performing loans. Many other facts are explanative, but it’s also worth mentioning the continuous difficulties of some countries in Europe, where the consanguinity between Governments and large banks is very strong…even if Insurance companies are not immune.

We still think it is possible to generate good returns with some specific banks because in some cases there’s real value, but as a longer term investment we feel much more comfortable with high quality insurance and reinsurance companies, which not only pay a good dividend, but also show resilience and growth.