Bike-to-school

September most often means back-to-school time. This year it takes place in a particular context. Our habits have been disrupted over the last few months, our mobility has been reduced, and there is an awareness of our own well-being and the environment.

Social distancing and lockdowns led people to adapt and seek ways to improve their well-being during this odd period. Doing some sport and exercising, but at home with online courses or the purchase of a connected home bike. Once the lockdowns were over, people were encouraged to use soft mobility and avoid public transportation, and a boom in bicycle sales was observed, a sector that was already demonstrating growth and a rising offering on the e-bike side. This is also leading to an increased awareness of the environment and the impact that we can have on it.

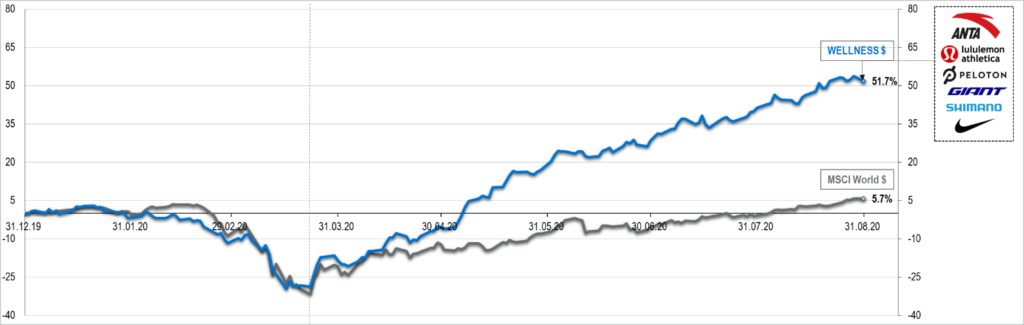

There is one investment theme that we have appreciated for several years, driven by the consumption habits of new generations: the quest for wellness. We are referring here to physical wellness through physical activities: activewear and equipment companies. Before the Covid-19 crisis, codes had already evolved a bit in sport with the improvement of the technicality of products, accessibility and digital. Today, we are in a connected and social sport. Companies in the sector were obliged to quickly adapt. We were already invested in this thematic and have increased our exposure since March (through three of our funds). We have favored companies that have worked their brand image with new generations using strong messages, proposing simple distribution channels, with a wide exposure to digital and we have avoided fitness centers. Many investors over-weighted technology and healthcare in this crisis, but one sector has strongly rebounded since March: it’s wellness. The graph shows a portfolio we created at the end of December 2019 with our exposures and future candidates in the sector. It holds 6 equally-weighted stocks with a monthly rebalancing. We observe a very strong rebound after being very volatile in March.

But where does the future lie? These companies have certainly benefited from a good momentum, but we are convinced that new habits will partially remain and that sports at home or outdoors, will continue to increase, this being a simple way to escape. These companies were good students and this basket offers today a PEG ratio in line with the MSCI World Index. Mobility is resuming around the world and China plays a big role in the strong growth of the activewear segment: the number of Chinese Marathoners is higher than five years ago, the government has set ambitious goals for the construction of sporting facilities and grants tax reductions for companies engaged in sports activities. In our opinion, the quest for wellness has a bright future ahead and is not just a Covid-19 play.

Past performance is not indicative of future results. The views, strategies and financial instruments described in this document may not be suitable for all investors. Opinions expressed are current opinions as of date(s) appearing in this material only.

References to market or composite indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only. Notz, Stucki provides no warranty and makes no representation of any kind whatsoever regarding the accuracy and completeness of any data, including financial market data, quotes, research notes or other financial instrument referred to in this document.

This document does not constitute an offer or solicitation to any person in any jurisdiction in which such offer or solicitation is not authorized or to any person to whom it would be unlawful to make such offer or solicitation. Any reference in this document to specific securities and issuers are for illustrative purposes only, and should not be interpreted as recommendations to purchase or sell those securities. References in this document to investment funds that have not been registered with the FINMA cannot be distributed in or from Switzerland except to certain categories of eligible investors. Some of the entities of the Notz Stucki Group or its clients may hold a position in the financial instruments of any issuer discussed herein, or act as advisor to any such issuer.

Additional information is available on request.

© Notz Stucki Group