2019: Everything was positive! 2020: Be selective!

One year ago, we stated the following conclusion when we summarized 2018:

“2018 was the “annus horribilis” of the capital markets with no place to hide to make money. 2019 has started with attractive valuations and some challenges (US-China trade war, Brexit, Central banks tightening). If history is any guide, we may say that after such a bad year, the market delivers good returns the following one. Our view is that we are facing a slowdown in the economy, but markets are incorporating prices that reflect a dramatic slowdown close to a recession.”

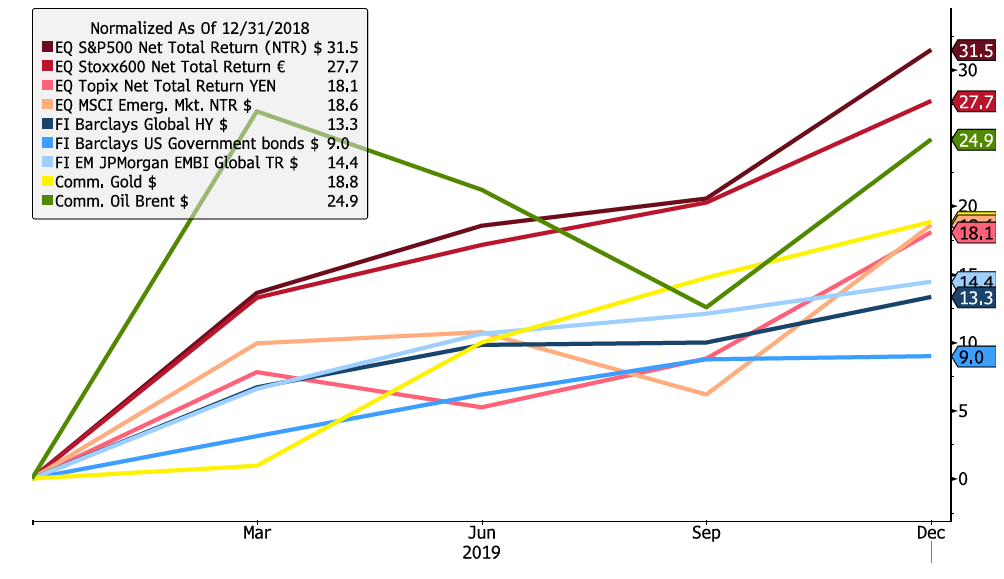

… and “voilà”, we have had an extraordinary year in all asset classes in 2019, for 3 main reasons:

- Many central banks across the world cut rates, injecting liquidity to the capital markets.

- The fears to a recession were dissipated and world economies experienced just a slowdown.

- US-China trade war already is part of our daily life, and a truce was agreed by the year-end.

EQUITIES

Once again, the US was the leading the market (+31.5%) with the strength of its good information technology companies. Although profits did not grow during 2019, valuations were very attractive at the beginning of the year. The same can be said for the other equity markets.

FIXED INCOME

The planets were aligned for the fixed income market: (1) Central banks cut rates, so Government bonds performed well; (2) the world economy slowed down, but continued with some growth so, corporate spreads compressed during the year in all asset classes; and (3) US-China trade war confrontation decreased and helped emerging markets. In this situation, many fixed-income assets achieved double digit returns in USD.

COMMODITIES

Gold had a remarkable 18.8% performance during the year (is it a safe haven when it appreciated with the rest of the asset classes?) following the more dovish monetary policy of central banks.

Oil had a good performance (Brent went up 24.9%) due to the reasonable oil demand in the world and the controlled supply by the main producers.

ALTERNATIVE INVESTMENTS

Final December performance for hedge funds are not yet available but many hedge funds sub-strategies had double digit returns, especially the equity hedge funds which may have been reached 14% performance for the year.

Private Equity, Private Lending and Real Estate funds had also a good year with massive inflows to these asset classes chasing some yield out of the low yielding returns of fixed-income securities.

CONCLUSION

Will the market mean revert again? After such an excellent 2019, investors may be tempted to believe that 2020 might give up some of these returns. Our “20/20” view is that we must be more selective during 2020, with a moderate positive view:

- Can we still call the European High Yield market high yield when YTM is only 2.6%? or, is it a low yield market?

- Investment grade bonds in EUR and CHF are mostly given 0% yield.

- In the equity market, if profits increase by 5% and dividend yields are at 2%, investors may expect around 7% return for the year.

- With valuations more demanding, it is key the selection of good managers both on the long-only side and on the hedge fund side. Active management will matter in 2020!

Be careful with the so popular illiquid strategies: Too much money chasing limited opportunities.