Cedric Dingens

Hedge funds: what positioning for 2024?

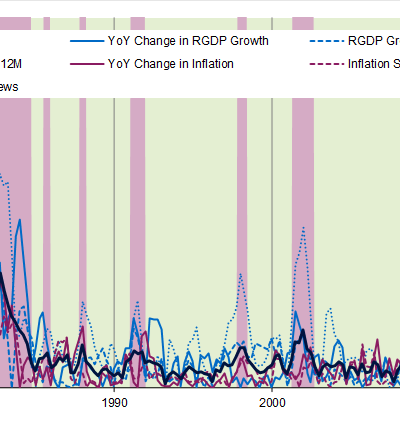

Chart of the Month – The game changer

Les stratégies hedge funds gagnantes pour 2023

Winning hedge fund strategies for 2023

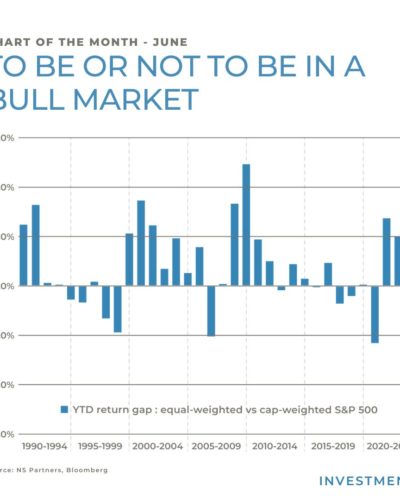

Graphique du mois – Être ou ne pas être dans un marché haussier

Gráfico del mes – Estar o no estar en un mercado alcista

Chart of the Month – To be or not to be in a bull market

“From TINA to TALA”

« From TINA to TALA »